Business Structures

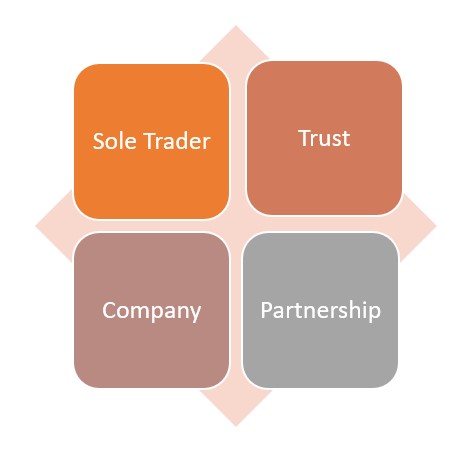

It is import to select the right business structure to maximize the economic return and to minimize the legal and economic risk for the owners. Different structures offer different outcome for the tax liability arising from various transactions. Getting the structure right at the start can save money and time in the future. Although restructuring may be done in future it can sometimes involve complex tax, legal and administrative matters along with being costly. You may start your own business as a sole trader, trust or private company structure. As your business grows, you may consider asset protection, fund raising or tax liability. Opportunities may come when new business partners show interest in your business. Your existing business structure may not be sufficient to deal with the issues due to these changes.

EXAMPLE OF changes when business restructuring may be required

Small business restructure rollover relief

With effect from 1 July 2016, the Tax Laws Amendment (Small Business Restructure Roll-Over) Act 2016 provides Australian resident Small Business Entities with a new roll-over for gains and losses arising from the transfer of CGT assets, trading stock, revenue assets and depreciation assets. This new form of roll-over relief will provide a greater level of flexibility by providing tax relief when assets are transferred to a sole trader, partnership or trust if certain conditions can be met.

OPPORTUNITIES

The small business rollover relief provides a significant opportunity for SME taxpayers to restructure their affairs in order to achieve a number of commercial outcomes.