ARE YOU READY?

Running your own business offers many benefits in independence, flexibility, satisfaction or creating wealth for your next generation. However, it is a lot of hard work. There is also financial risk and your personal assets might be at risk if you leave behind a secure pay packet and company benefits such as superannuation and paid leave.

Build you own business from scratch or buying an existing business or franchise

When people think of building a business, they think of beginning from scratch. The challenges might involves difficulty of building a customer base, marketing the new business, hiring employees and establishing cash flow.

Buying an existing business can be as easy as taking over an operation that’s already generating cash flow and profits. You have an established customer base, reputation and employees who are familiar with the operations. Bankers may feel more comfortable dealing with a business that already has a good record to show profitability.

Franchises offer the independence of small business ownership supported by the benefits of a big business network. You don’t need business experience to run a franchise. Franchisors usually provide the training you need to operate their business model. It provides a higher rate of sucees than start-up businesses. However, franchise agreements dictate how you run the business and there may be little room for creativity. There are also restrictions on where you operate, the products you sell and the suppliers you use. Buying a franchise also means sharing of profit with the franchisor.

WRITING A business plan

Business plan can visualise the following:

- Vision for the business

- Product/service offering

- Marketing strategy

- Business structure

- Finances and cashflow

- Action Plan

Others matters to consider

Business names

Registrations you need

Tax issues

Tax Registrations are required before a business starts trading. Australian Business Number (ABN) and Tax File Number (TFN) are required to be obtained from the Australian Taxation Office.

Tax Reporting and paying tax

Our financial tax year is from 1 July to 30 June. Income tax returns are required to be filed with the Australian Taxation Office every year. Income tax is calculated on the net profit of businesses. You may be eligible for a range of deductions for business expenses to reduce your assessable income. If required the tax year can be changed in accordance with a holding company’s overseas tax reporting period.

Business activity statements (BAS)

Goods and services tax (GST) is a broad-based tax of 10% on most goods, services and other items sold or consumed in Australia.

If you are a business, you use a BAS to report and pay the GST your business has collected and claim GST credits.

BAS reporting can be on a cash or accruals basis. Quarterly BAS reporting is the most common type. Monthly and annual GST reporting are also available for different GST circumstances.

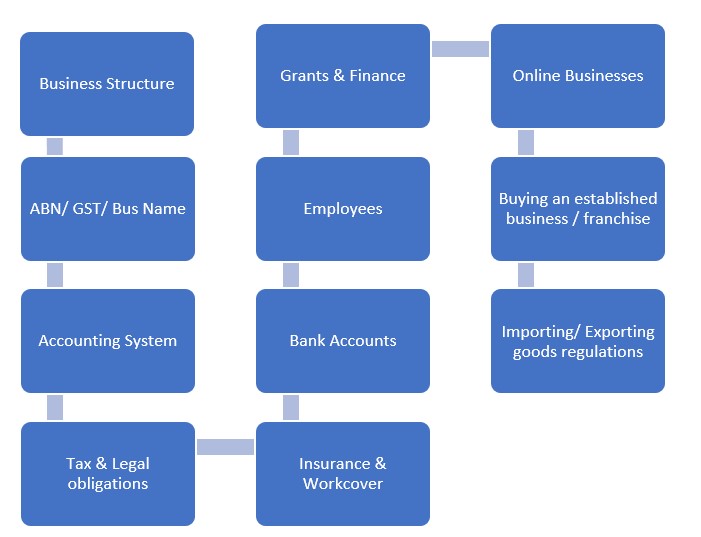

START YOUR BUSINESS CHECKLIST

- Consider a business structure

- Apply for Australian business number (ABN), goods and services tax (GST) and business name

- Setting up record-keeping and accounting systems

- Understand your tax and legal obligations

- Arranging business insurance and workcover

- Setting up business bank accounts

- Employing people and work health and safety regulations

- Grants and finance assistance

- Online businesses

- Buying an established business or a franchise

- Importing and exporting goods regulations

It is not always easy when starting a business. We offer advice and support to assist you to setup your new. Services including advising proper business structures and accounting system, provision of taxation and accounting advice, preparation of financial reports and tax returns. We also have strong connections with lawyers, bankers, insurance brokers, business brokers, real estate agents, human resources and information technology consultants.